I have the luxury of teaching a course called Consumer Math. This is a half-year course aimed at providing seniors with a 3rd or 4th math credit and I have free reign over content and pacing. This freedom is great because I can follow any interesting topic that comes up and I’m pretty sure that (at least sometimes) they too are fully interested.

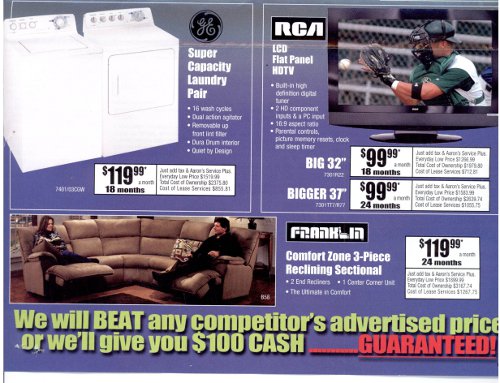

Luckily I get junk mail. The following flyer came in my snail mail:

This is a flyer from a company called Aaron’s and it is a rent to own type of company. You pay their monthly payments and at the end of the rental period you own the item. This company preys on customers who have poor credit. I brought in the flyer and asked the kids: Is Aaron’s breaking the NY state law by charging too high of an interest rate?

This group of students can be tough to engage but they get all fired up when they have the feeling that “the man” is ripping people off. I talked about the NY state law for usury being 16% interest rate and everything over that limit is against the law (I’m not a lawyer, so in reality this is just nice bait to get the students riled up).

Then I pick out one of the deals:

Some students start calculations right away, but for the majority of the class I lead with questions.

How much do you pay to Aaron’s? $1979.80 (Naturally they add-on an extra 10% for Aaron’s Service Plus)

How much interest is this if the “everyday low price” is $1,266.99? 37.5%(They know the I = P*r*t formula)

WOW! These guys are charging a lot of interest!

…. wait for it … “But Mr. Anderson that TV doesn’t cost $1,266.99!” We look it up, a 32in RCA LCD tv costs $358 at Wallymart.

Now just about everyone starts finding the real interest rate on their own…

302%

The assignment for the day was pick 3 other products and find the interest rates (the Aaron’s rate, and the real rate). Neat stuff, I think this was the first time in 4 years of getting the Consumer math students truly interested in the interest rate calculations. Despite their limited knowledge or care about interest rates they know that 38% for an interest rate is rough, but 300% is flat out robbery!

14 Responses to Aarons (Rent to Buy)

Pingback: Analysis of Rent to Buy | WNCP Orchestrated Experiences for High School Math

Pingback: Rent-to-Own Put to the Test – MathSciWhy